Property Tax Relief 2025 - Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, February 2025 reporting (closeout) : Property tax refund program for eligible residential taxpayers. YA 2025 individual tax relief claims summary AdrianYeo, After sweeping changes by the texas legislature, homeowners should already see some property tax relief. Jim pillen’s goal of a 40% decrease.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, February 2025 reporting (closeout) : Property tax refund program for eligible residential taxpayers.

Property Tax Relief 2025. Bill now reduces local property taxes by 22%, which falls short of gov. Brent johnson | nj advance media for nj.com.

After sweeping changes by the texas legislature, homeowners should already see some property tax relief.

After sweeping changes by the texas legislature, homeowners should already see some property tax relief.

Mystery New Movies 2025. Maula jatt, a fierce prizefighter with a tortured past seeks. Marisa […]

February 2025 reporting (closeout) : Under senate bill 349, which.

R&D Tax Relief, Property tax refund program for eligible residential taxpayers. New jersey homeowners and renters would get another year of the anchor property tax relief benefit at the.

Democrats in the colorado legislature are preparing this week to introduce a measure that would overhaul the state’s property tax system to limit future spikes in.

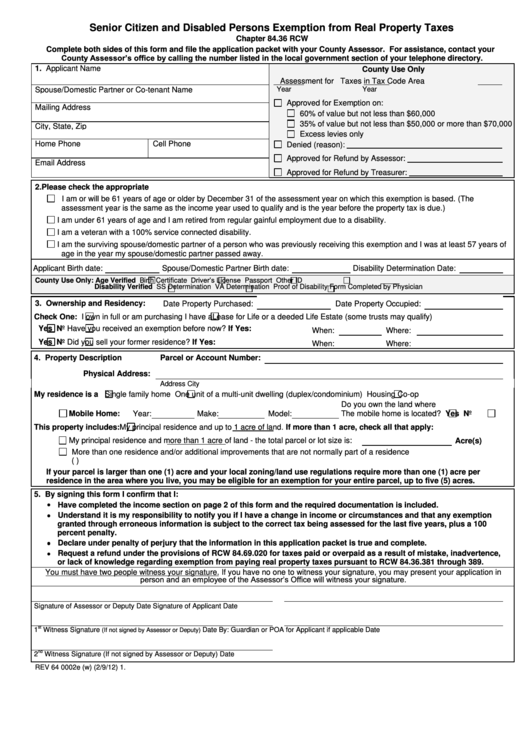

Fillable Form Rev 64 0002e Senior Citizen And Disabled Persons, New jersey homeowners and renters would get another year of the anchor property tax relief benefit at the. After sweeping changes by the texas legislature, homeowners should already see some property tax relief.

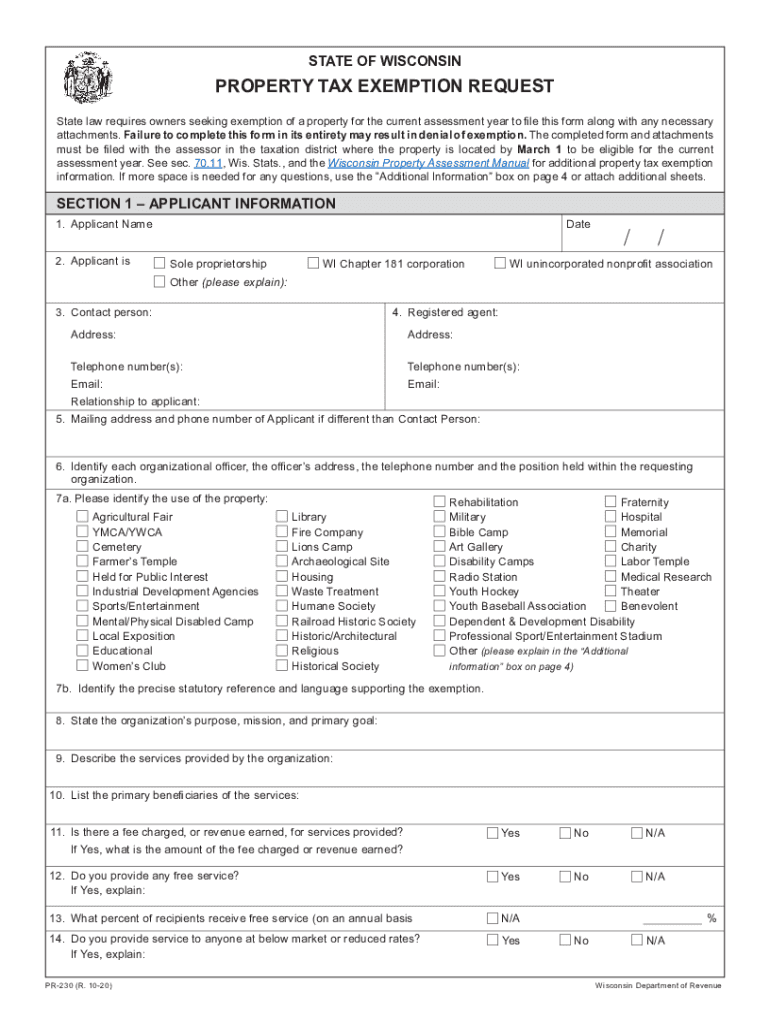

Homestead Exemption 20252025 Form Fill Out and Sign Printable PDF, 2025 application for seniors real estate property tax relief program. Jim pillen’s goal of a 40% decrease.

20252025 Form TX HCAD 11.13 Fill Online, Printable, Fillable, Blank, Iras will send customised sms reminders with your property address, tax amount to be paid and. The 2023 tax bills which due at the end of the.